CORPORATE AND PUBLIC SECTOR

Audit

Companies that are required, either by law or by the board, to have their accounts audited can rely on us to provide confidence in the accuracy of the financial statements and highlight any areas within the company that may be susceptible to errors or fraud.

Our cost-effective audits ensure that every ‘i’ is dotted and ‘t’ crossed, and our wealth of experience allows us to deal with all types of audits including: pension scheme audits, Solicitors Regulation Accounts Rules audits & charity audits.

Due Diligence

Buying a business or merging companies is a task which can be fraught with risk. We can prepare a due diligence report to aid your decisions, allowing you to:

- Properly assess the viability of a purchase

- Assess the financial and non-financial risks of a purchase

- Discover potential “off balance-sheet” issues

- Aid in your negotiations

- Give confidence in a purchase

Business Advisory

Business Advisory

Our expert business advisors can help you to make the best possible decisions based on excellent financial analysis reporting. We will help you to see through the numbers, showing you:

- Where you can save money

- How effective your investments are

- How you can plan for the future

Corporate Re-structuring

Occasionally, companies and groups may have to restructure in order to expand or divert resources. At Clay Ratnage & Co., our expert advisors can help to guide you through this process and give tailored advice to help your company achieve its goals.

We are experienced in obtaining clearance from HMRC for complex and innovative reorganisations. Scroll down the page to the Case Studies section to view examples of our work in this area.

Employee Incentive Schemes

In order to get the most out of your Employee Incentive Schemes, Clay Ratnage & Co. can help you to:

- Establish your objectives and targets to be reached

- Assess the impact of your incentives

- Measure the success of the scheme

- Consider alternative approaches to staff management

Charities

At Clay Ratnage & Co., we have the ability to provide clear, accurate and SORP conforming accounts for charities and not-for-profit organisations. We can also help to advise on:

- The implementation of SORP

- How internal control systems can be established and improved

- Understanding your management accounts and financial statements

Pension Schemes

We understand that each pension scheme is uniquely structured and requires a tailored approach for the preparation of financial statements and audit. We can help to:

- Prepare the accounts and audit for your pension scheme

- Give recommendations for the improvements of internal controls

- Help to set up your pension scheme

- Give technical advice

Academy Schools

Academy status brings with it new financial challenges and responsibilities which require effective management and budgetary controls.

Converting to Academy Status

At Clay Ratnage & Co., we have a specialist team to help guide head teachers, governors and finance executives through the academy conversion process and the provision of support services and advice beyond. Our team is fully trained in the Academies Financial Handbook and Accounts Direction as well as charity accounting and reporting standards.

Academy services and support

- Assistance and attendance at meetings to help you decide if you should become an academy

- Internal audit, external audit and other assurance services

- Implementation and support of financial systems and controls

- Preparation of annual financial systems and controls

- Preparation of management accounts, budgets and cashflow forecasts

- Assisting or acting as your Responsible officer

- VAT and taxation advice

- Payroll support

- Software systems review, assessment and advice

- Assisting in meeting the requirements of the Education and Skills Funding Authority (EFSA)

- Due diligence for potential mergers into a Multi-Academy Trust (MAT)

Specialist audits

Solicitors Accountant’s Reports

- Provide recommendations for improving compliance and record keeping

- Provide an Accountant’s Report to the SRA

- Accounts preparation for solicitors

- Accounts preparation for solicitors

- Advice on restructuring and changes in partnerships

FCA Reports

We provide a wide range of services for FCA registered business including:

- Accounts preparation

- FCA audits

- Audit and assurance reports

Case Studies

DEMERGER

Removing a company from a group

Company A Ltd is the parent company of a group consisting of B Ltd, C Ltd and D Ltd. The directors are the same for each company within the group.

A Ltd owns 100% of the shares in B Ltd who subsequently own 100% of the shares in both C Ltd and D Ltd. Each company has 100 ordinary shares and B Ltd has a share premium account of £1000.

Following a reorganisation of the group and its operations, it was decided that B Ltd was no longer required within the new structure. It was decided by the directors that the shares in C Ltd and D Ltd were to be transferred to A Ltd whilst B Ltd was to be dissolved.

The directors of A Ltd approached us and asked what the best way to achieve this was.

We advised the client to carry out the following for B Ltd:

The first step is to reduce the share premium account in B Ltd to £nil. In order to do this, B Ltd need to pass a special resolution at an Extraordinary General Meeting to reduce the share premium account from £1,000 to Nil.

The Special Resolution needs to supported by a signed Statement of Solvency from the directors which will confirm the following:

- That it is the intention to wind the company up within the next 12 months of the date of the Special Resolution

- That the company will be able to pay its debts in full within the next 12 months

A Statement of the Directors needs to be prepared and signed confirming their support of the Special Resolution. Form SH19 needs to be completed confirming the new share capital – a cheque for £10 to cover the filing fee is also required.

Once all of the above forms and statements have been completed, these are sent to Companies House for approval. Upon approval of the Special Resolution, the shares in C Ltd and D Ltd can be transferred from B Ltd to A Ltd, via a Share Transfer form. B Ltd can then begin the process of dissolving the company.

As a firm, we will guide the client through the process, preparing all the necessary documentation on their behalf.

DIVESTING OF TRADE

Selling part of your trade

A Ltd is a trading company owned by two shareholders. Each director owns 50% of the ordinary share capital.

A Ltd owns a number of investment properties and also carries out the servicing and maintenance on both its own properties as well as a large number of other properties.

The directors are reaching retirement age and wish to retire from the labour-intensive side of the business whilst retaining a passive income through the company from its investment properties.

An employee of the company stated an interest in buying the servicing trade from the company and carrying on this part of the business.

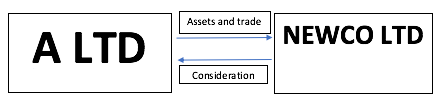

It was decided with the employee that a new company (Newco Ltd) should be set up and the relevant assets of the company sold to the new company, of which the employee would be the sole shareholder of.

We were approached to guide the client through this process.

A new company was formed at Companies House and registered with HMRC. Due to the size of the trade being transferred, the new company (Newco Ltd) was registered for VAT with HMRC. This is an important step for selling part of a business as a going concern, detailed below.

Next, the assets relevant to the servicing trade were identified which included a number of vans, tools and equipment and other miscellaneous items. Additionally, the clients of the company were notified of the change of ownership and it was agreed that these contracts could be transferred to Newco Ltd at the required date. Collectively the assets and contracts make up a going concern which means that Newco Ltd will be able to carry out the trade with no break in that trade.

A sales price was agreed by the parties which took consideration of the value of the assets as well the value of the business as a going concern. The value in excess of the assets is known as goodwill and will be subject to corporation tax in A Ltd.

Once the assets have been handed over to Newco Ltd and the money received A Ltd will have successfully divested its trade and Newco Ltd will begin its trade.

The final considerations of this transaction relate to the taxability of the goods sold to Newco Ltd as well the goodwill. Under normal rules the sale of assets or goodwill without other elements of the trade are subject to VAT. However, in the case of a transfer of going concern the sale of the trade is deemed to be outside the scope of VAT and as a result is not taxable. This means that VAT can be ignored by both the seller and the purchaser.

Tax does, however, arise within A Ltd as both the sale of its assets and the sale of the goodwill is chargeable to corporation tax.

SETTING UP A HOLDING COMPANY

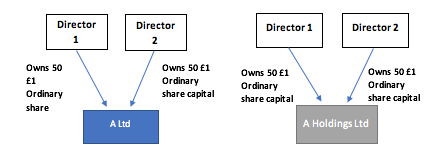

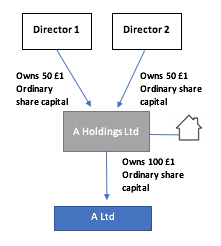

A Ltd is a trading company owned by two shareholders. Each director owns 50% of the ordinary share capital.

The directors are going to purchase a commercial property for use by the trading company. They would like to protect the high value asset against any potential losses or debts incurred by the trading company.

The directors approached us for advice on how they might protect the property. We advised the client to restructure their business by setting up a holding company. A holding company typically does not have a primary operation to produce goods or services, but instead holds the shares and other assets of a subsidiary company.

The first step is to set up the new holding company. A new company is formed at Companies House and registered with HMRC. The new company; A Holdings Ltd, is a separate legal entity to A Ltd. The share and ownership structures of the two companies are as follows:

A clearance letter is then sent to HMRC to outline the plans of the proposed new structure of the company. The letter details the current activities of the trading company and the commercial decision associated with setting up the holding company, namely the protection of the commercial property. The new property will be purchased by the holding company. In addition, A Holdings Ltd will also own 100% of the ordinary share capital of the trading company.

The A Ltd ordinary share capital will be transferred from Director 1 and Director 2 to A Holdings Ltd; this is applied for using a J10 Transfer Form. Each director will need to complete the Share Transfer form.

Finally, the PSC register will need to be updated to show A Holdings Limited to be the controlling party of A Ltd.